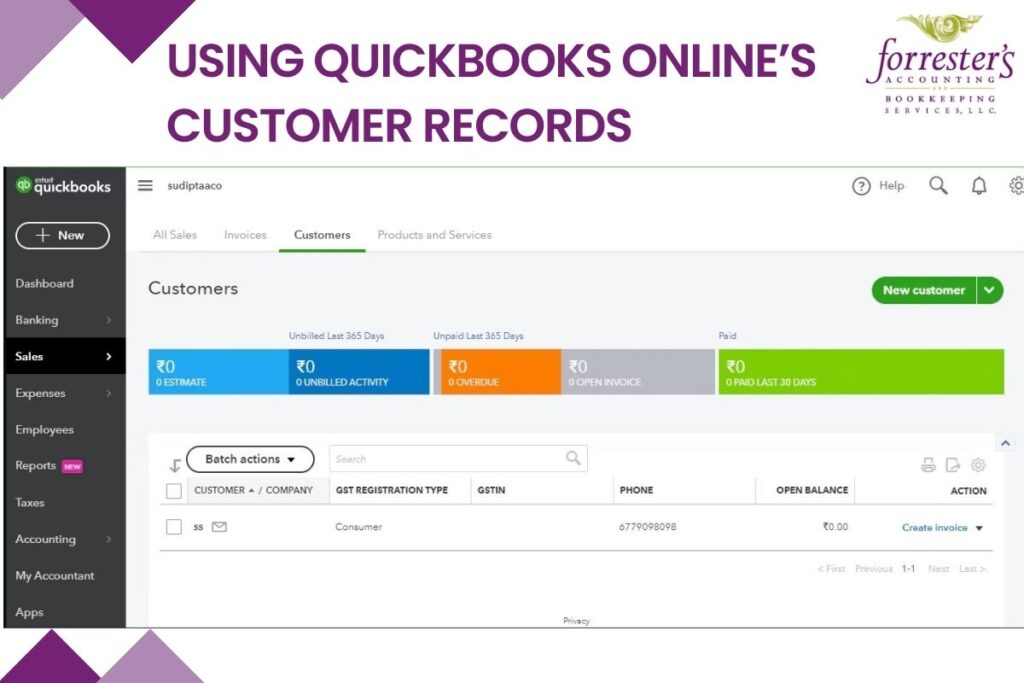

Using QuickBooks Online’s Customer Records

Using QuickBooks Online’s Customer Records Your customers are your company’s lifeblood. Are you managing those relationships carefully? Here’s how QuickBooks Online can help. If you’ve been in business long enough to remember tracking your customers manually, you probably rememberwhat a nightmare it was. Maybe you had a card file and paper folders – and lots […]

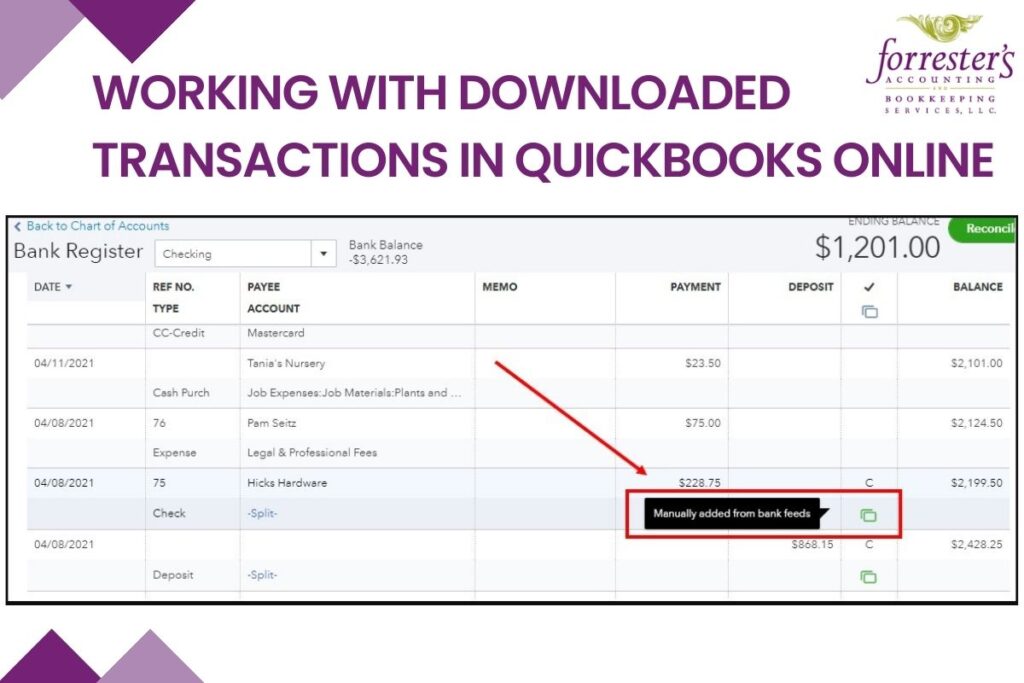

Working with Downloaded Transactions in QuickBooks Online

Working with Downloaded Transactions in QuickBooks Online Downloading transactions into QBO is the easy part. You still have work to do once they’re on board. Its ability to download financial transactions is one of the five best things about QuickBooks Online. Without it, you’d spend a lot of time on tedious data entry, verifying which […]

Setting Up Sales Tax in QuickBooks Online

Sales tax is one of the more complicated concepts supported by QuickBooks Online. QuickBooks Online was designed for you, the small businessperson. You’ve probably discovered that many of its features are fairly easy to use from the start. But just because QuickBooks Online can do something doesn’t mean you should attempt it on your own. Sales tax is […]